2018 New Snowmobile Sales Increase In U.S., Canada And Worldwide

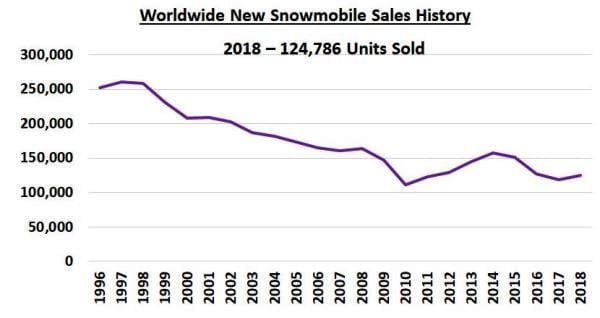

The snowmobile industry reclaimed a growth market status in the newly completed 2018 sales season, with worldwide sales of new sleds increasing by 5.2 percent, paced by strong growth in both the United States and Canada and aided by some late snow storms in key markets.

According to information gathered by the International Snowmobile Manufacturers Association (ISMA) and presented by ISMA President Ed Klim at the International Snowmobile Congress in Nova Scotia on June 15, sales of new snowmobiles during the 2018 selling season (from May 1, 2017 through April 31, 2018) totaled 124,786 units worldwide, compared to 118,657 during the previous selling season, and 126,972 during the 2016 period.

Canada had the largest sales margin growth, with new sled sales going from 44,161 in 2017 to 47,024 in 2018 – an increase of 6.5 percent, or 2,863 units. The U.S. again had the most sleds sold overall, and ranked second in terms of growth, with sled sales of 53,179 in 2018, compared to 50,659 in 2017 – a 2,250-unit, or 5 percent increase. Finland rounded out the top three with 3,627 units sold in 2018, compared to 3,032 in 2017. Sweden remained the third largest market for new snowmobiles, with 10,159 units sold there, while 5,071 new sleds were sold in Norway.

Segregating the U.S. by region, the Midwest accounted for roughly 42 percent of total sales, followed by the Northeast and West vying for a near tie at approximately 29 percent. In Canada, the Northeast accounted for 49 percent of the sales, while the Midwest accounted for about 32 percent and the west was 19 percent.

“The key determinant of demand is snow, because if you look at everything else – income is up in the United States and Canada; wealth is up in the United States and Canada; confidence is up, gas is reasonably priced – all it has to do is snow,” Klim said in an interview with Snow Goer. “I saw that it snowed like a banshee in British Columbia and there was big snow in Quebec, and in both of those provinces they had substantive sales increases. Wherever it snowed a lot, it worked.”

A late burst of sales that was spurred on by March and April snow in places like Minnesota, Wisconsin, Michigan and Maine; not everybody got to ride that time of year, but the big storms fueled enthusiasm and attracted some late purchases.

Another encouraging sign was that the sales figures improved pretty much everywhere – including throughout Scandinavia.

“We were up between 4 and 5 percent in every single market, including Russia,” Klim said. “When you’re up in every market versus what’s going on with economic growth reports from other countries, we’re doing pretty good. We outperformed a lot of economies, which was a pleasant surprise.”

Klim said he’s expecting Russian sales to recover, due in part to improvements to its economy after a boom-and-bust cycle. Russian sales topped 30,000 units as recently as 2014, but came in at only 3,404 units sold in 2018.

Anecdotally, one growth market could be Norway; Klim said that Norwegian attendees at the annual gathering indicated strong dealership and trail system growth could be on the horizon.

More Powder Equals Extra Purchases

Naturally, snow availability remains the most influential determinant of active ridership that propel new sleds sales, but the market is also aided when the economy is strong.

Klim said the sales figures indicate that the industry could be poised to benefit from the stabilization of an economic rebound, the result of which increases disposable income for many households.

“There’s a certain comfort level now that things are OK where they are at. We wish we were selling more, but we saw some growth and quite honestly, we are looking at continued growth next year,” Klim said. “[The snowmobile manufacturers] are getting good response from some of the shows that they’ve held [in the spring selling period] and I think next year we’re going to do a little better next year than we did this year. We think we stopped the avalanche.”

The 2018 new sled sales figures include 2018 models as well as new, unsold models from previous years – also known as “non-current” new models. They do not include any 2019 sleds that were pre-ordered in the recently completed spring sales season – a sale is considered official when the actual snowmobile is delivered to a customer, not when a down payment is made.

If Mother Nature is willing to provide bountiful snow, next season should be a fun one for both consumers and manufacturers alike.

Editor’s Note: Every issue of Snow Goer magazine includes in-depth sled reports and comparisons, aftermarket gear and accessories reviews, riding destination articles, do-it-yourself repair information, snowmobile technology and more! Subscribe to Snow Goer now to receive issues delivered to your door 6 times per year for a low cost.

Worth mentioning is that Sweden have not in over 40 years sold this many sleds (10614 units according to Swedish snowmobile media) in a season