2019-20 Snowmobile Sales Slip But Remain Strong

Sales of new snowmobiles took a slight dip in 2019-20, thanks in part to an abrupt end to the riding and selling season brought on by the arrival of the COVID-19 coronavirus pandemic in March, according to data released by the International Snowmobile Manufacturers Association (ISMA) on Thursday.

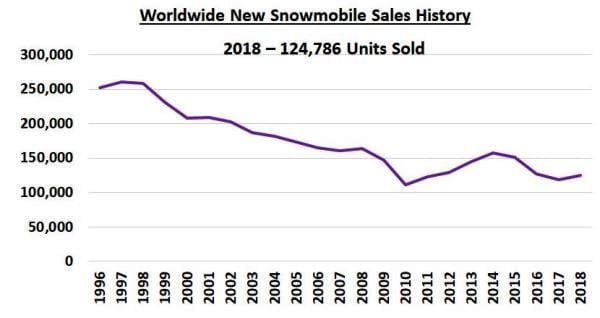

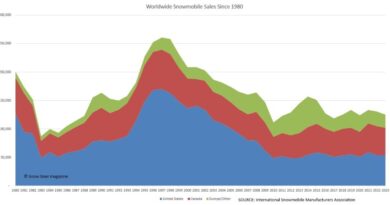

Worldwide sales of new snowmobiles for the selling season that runs from May 1, 2019, to April 30, 2020, dropped 7 percent worldwide to 123,862 total units, essentially giving back a similar size increase a year earlier and coming very close to the five-year annual sales average of 125,472.

Unlike some years where a certain geographic location increased while another decreased, the dip in sales was rather consistent worldwide, including in the largest markets in the U.S. and Canada as well as overseas – which largely consists of Scandinavian countries and Russia.

Production cuts at some factories may have also played a role, as there were far fewer Arctic Cats for sale in the field this past year, for example.

In an exclusive interview with Snow Goer, ISMA President Ed Klim spelled out the COVID impact from the manufacturers’ perspective.

“We were doing the monthly [sales] reports like we always do. We start in September, and we were looking at a pretty darn good [sales] year from our perspective as we were doing the counts,” Klim said. “Sitting here in the ISMA office [in Haslett, Michigan], we were thinking, ‘You know what, by the end of March we’ll be ahead of last year.’ Then all of a sudden March 10-11-12 hit and shut down the business.

“That’s 15-20 days that usually – like last year, we looked at last year and we had a lot of snow and those are usually real good days of sales, but then, son-of-a-gun,” Klim continued, referring to the COVID-19 shutdown. “We had great snow for March [in many areas] and into April for sure Michigan in the U.P., but certainly in March we had great snow all over the state and in a lot of places, but [sales] just stopped. Those are good sales days – the dealers and manufacturers all had special options and pricing… People just stayed home.”

The sales figures in this story include 2020 models as well as recent, so-called “non-current” new models carried over in dealer stock — so, for instance, still-new 2019 and 2018 models. The figures don’t include any 2021 models, for which customers could place orders this spring, but they won’t be counted in official industry statistics until they are delivered to customers next fall.

A Deeper Dive: North America

New sleds sales in the U.S. dropped by about 4,000 machines, or 7.25 percent, from 55,025 units a year earlier to 51,036 machines in the 2019-20 selling season. Sales of new sleds in the U.S. have varied between 48,000 and 58,000 units for the past 11 selling seasons – often influenced by winter weather conditions and economic realities.

In Canada, new snowmobile sales slipped by 6.94 percent across the country to 43,535 units for the 2019-20 selling season compared to 46,784 the previous year. Historically, Canadian sales haven’t been above 51,000 units since the 1999-2000 selling season, and stayed above 40,000 every year except 2010.

Speaking about regional differences, Klim said, “The West did outperform the rest of the country, followed closely by the Midwest, but there was softness in the East and Northeast in the U.S. In Canada, Quebec is the rockstar – they sell a lot of sleds there.”

The upshot is that, due to production cuts, the so-called “pipeline” of new, unsold sleds sitting at dealerships is quite clean, Klim said.

“Our inventory is at one of the lowest levels we have been at in the last 10 years,” Klim said. “I can’t give exact numbers, but it’s certainly a workable inventory number that I think everybody is comfortable with. It went down again.”

International

Sales in Finland bumped up in the 2019-20 selling season, increasing from 4,581 units to 5,094 machines, and Russia also saw an increase to 7,191 new sleds sold compared to 6,441 the year before. Still, Russia’s numbers pale in comparison to the 30,000 units sold there in the middle of the last decade, before the Russian economy declined sharply.

Klim said Norway was flat and Sweden lost some sales. With those countries, plus Norway and a few others where snowmobiling is allowed, overseas sales of new sleds slipped from 31,272 last year to 29,291.

Optimism

Anecdotally, we’ve spoken to several dealers in the boating and powersports markets who have had very strong sales of boats, UTVs and motorcycles in late April and May, as consumers find fun ways to socially distant, so worries about impending doom have been calmed.

Klim said the manufacturer officials he deals with also remain optimistic about the future of the snowmobiling and have been eagerly planning for the short- and distant-future for the sport, despite the struggles of the economy.

Editor’s Note: Every Snow Goer issue includes in-depth sled reports and comparisons, aftermarket gear and accessories reviews, riding destination articles, do-it-yourself repair information, snowmobile technology and more. Subscribe to Snow Goer now to receive print and/or digital issues.

What were the sales number breakdown of snowmobiles by manufacture in the USA

Pingback: Maine, Northeast expect busy snowmobiling season: report

Pingback: 20 Percent Jump In Sled Sales Is National News | SnowGoer

Pingback: Electric Sled Maker Taiga Ramps Up For Production | SnowGoer

Pingback: Snowmobile Market Posts Big Gains In 2021 | SnowGoer