Sales of new snowmobiles surged ahead in North America in the 2020-2021 selling season, growing by 16 percent in both the United States and Canada. The growth is similar to sales increases seen in many other outdoor markets during the COVID era, and could have been even higher if dealerships hadn’t run out of product to sell. Dealer inventories are at record lows.

The numbers, announced Friday, June 11, by Ed Klim of the International Snowmobile Manufacturers Association at the International Snowmobile Congress (ISC) in Nebraska, represent a sterling comeback for snowmobiling. In fact, both the 59,234 units sold in the United States and the 109,801 units sold in North America were each the highest recorded since 2009.

Overseas, though, sales of new snowmobiles slid, which brought the worldwide sales of new machines in at 133,444 units – up 8 percent over last year’s 123,862.

“We had a pretty darn good year – sales of snowmobiles worldwide were 133,444,” Klim said to the crowd of grassroots organizers at the ISC event. “In a pandemic world, that’s not too shabby.”

Annual sales in the snowmobile market are a reflection of “new” models sold and delivered to customers between May 1 the previous year through April 30 of the current year. They include new/current model machines (in this case, 2021 models) and recent, non-current new models that were still in inventory at dealerships. The numbers do not include “spring-order” machines for which customers put a down-payment this spring but which will be delivered until next fall and winter.

Inside The U.S. Numbers

The 16.1 percent increase in new sled sales in the U.S. marks the biggest year-over-year jump, in terms of percentage, in the snowmobile market since 1995. In that era, the snowmobile market was selling 148,000 units annually in the U.S.

Plus, the 59,234 units sold in the 2021 sales season was the biggest raw number the market sold since 2009, when 61,593 new sleds were retailed.

This comes at the same time that several manufacturers said spring pre-orders of 2022 models were through the roof – meaning the momentum is expected to continue going forward.

Klim’s address to the crowd did not include any mention of dealer inventories – a topic he normally covers. However, when we asked directly after his presentation, Klim said inventories were “at their lowest in history. There are maybe 1,000 or 2,000 units out there – the dealers are almost empty on new sleds across the country.”

The jibes with what we and our sister publication, Powersports Business, has heard from multiple dealers in the last six months – that they quickly sold out of both new and used snowmobiles last fall and winter, and could have retailed more machines if there was more product available.

In a rare move, this year Klim shared some exact sales numbers for the top three U.S. states. Minnesota led the way with 8,202 new snowmobiles sold in the 2021 sales season, with Wisconsin second at 6,873 and Michigan third at 5,225.

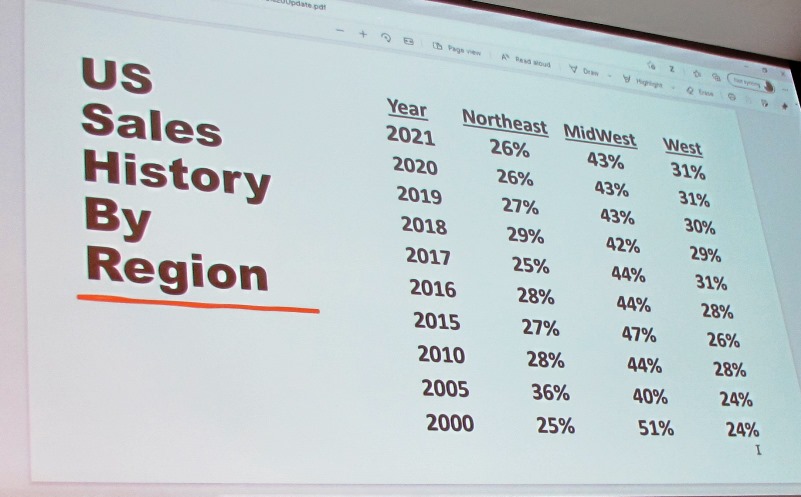

Regionally, the Upper Midwestern states accounted for 43 percent of the new sled sales in the country, with 31 percent in the West and 26 percent in the Northeast. Those were the same exact percentages as last year.

Looking Good In Canada

Canada also saw a burst in sales, jumping 16.1 percent to 50,567 units – the highest number recorded there since 2015 (when 50,752 were sold). Before that you have to go back to 2002 to find a higher number (50,719). And, as a percentage, the 16.1 percent is the biggest rate of year-over-year growth since the 1970s.

The numbers were largely driven by the province of Quebec, where 19,259 new snowmobiles were retailed, Klim said. That’s 38% of the total in Canada, and another 11,350 units (22% of Canada’s total) were sold in Ontario.

“We sold a whole bunch in Quebec and Ontario,” Klim said. “Number three, which used to be a higher number 3, was Alberta at 3,856,” he added, noting that there was a time that Alberta accounted for upwards of 14,000 units by itself. That’s when the oil industry was booming there, he said.

Regionally, the East accounts for 49 percent of Canadian sales, the Midwest for 33 percent and the West at just 18 percent.

Oversea Sales Slump Slightly

The story wasn’t quite as rosy overseas, however. Sales of new sleds decreased in much of Scandinavia and Russia, leading to an overall decrease outside of North America. It went from 29,291 units last year to just 23,643 this year – the lowest overseas total since 2003.

Sweden was the only “winner” on the international stage, posting a 157 unit increase from 8,326 units in the 2020 sales season to 8,483 in 2021.

Elsewhere in Scandinavia, Norway dropped from 4,768 to 4,126 snwomobiles and Finland dropped more substantially, going from 5,094 last year (which was its highest in years) to 3,437 this year – a 26 percent decrease. Klim noted that economic factors, a harsher COVID effect and a light snow winter were all factors in the decrease.

Snowmobile sales in Russia also sufered a setback, dropping from 7,191 units in 2020 to 5,309 for the just-completed 2021 selling season. Russian sales peeked in 2013 and 2014, when more than 30,000 units were sold annually over there and it looked to be a huge new market for the sled makers. But problems both policial and economic caused Russian sales to quickly collapse to just 3,404 units in 2018. Russian sled sales started to rebound the past two years but now turned south again.

There were 2,288 sleds sold in the rest of the world. Klim said that number includes places like Poland, China, and Chile, among others. That number reflect a big decrease, in terms of percentage, to last year’s 3,912 units.

The numbers that ISMA tracks are for sleds made by its members: BRP (Ski-Doo and Lynx), Polaris, Textron/Arctic Cat and Yamaha. They do not include any snowmobiles made by smaller manufacturers in Russia or China.

Editor’s Note: Every Snow Goer issue includes in-depth sled reports and comparisons, aftermarket gear and accessories reviews, riding destination articles, do-it-yourself repair information, snowmobile technology and more. Subscribe to Snow Goer now to receive print and/or digital issues.

Pingback: North American snowmobile sales increase 16%