Ski-Doo’s parent company BRP announced this morning it is acquiring an Austrian subsidiary of a Chinese powerhouse that describes itself as “a world-renowned SUV and pickup manufacturer.” Confused? Join the club.

The Great Wall Motor (GWM) corporation has offices and factories all over the world, and partnerships with many automotive and industrial companies around the globe. BRP’s acquisition is focused on GWM’s electric vehicle R&D center in Austria.

The move seems to reinforce BRP’s commitment to providing electric-power options throughout all of its existing product lines. It gives BRP 53 experienced employees in the general area. It also comes on the heels of BRP announcing it was breaking ground on a new Rotax R&D Center in Austria last week. If and /or how it ties BRP to the huge GWM company? We’re not sure. We’ll keep digging, but for now here’s the press release (below) that we stumbled upon on LinkedIn:

BRP ENTERED INTO A DEFINITIVE AGREEMENT TO ACQUIRE GREAT WALL MOTOR AUSTRIA, REINFORCING ITS KNOW-HOW IN ELECTRIC VEHICLES TECHNOLOGY

July 7, 2022 at 8:30 AM EDT

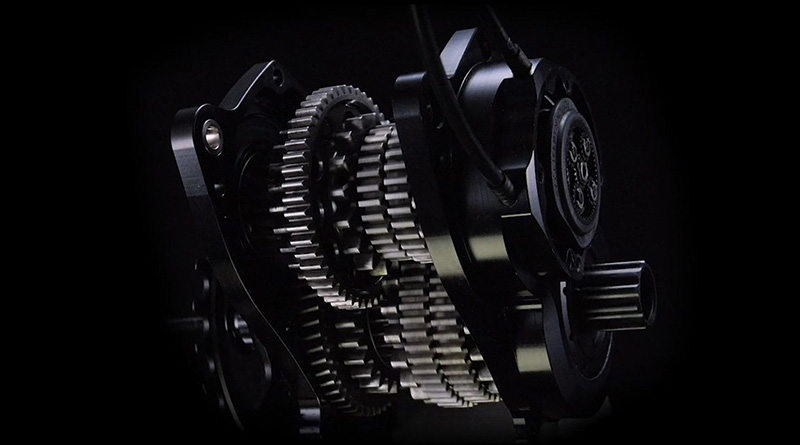

Valcourt, Quebec, Canada, July 7, 2022 – BRP (TSX:DOO; NASDAQ:DOOO) announced today that it has entered into a definitive agreement to acquire Great Wall Motor Austria GmbH, a subsidiary of Great Wall Motor based in Baoding, China. This leading EV R&D centre based in Kottingbrunn, Austria, specializes in e-drive systems and transmissions and currently employs highly skilled individuals who will receive ongoing employment as part of this agreement.

“We look forward to welcoming the 53 very qualified and experienced engineers, technicians and professionals as we continue reinforcing our EV expertise required to deploy our ambitious strategy. This acquisition will further strengthen our know-how in e-motor, inverter hardware and software development”, said Thomas Uhr, Chief Technology Officer of BRP.

Located near Vienna, Austria, this new EV R&D hub is ideally situated to attract top talent from nearby universities and research centres.

The transaction is subject to customary closing conditions, including the receipt of Austrian regulatory approvals and is expected to close by the end of Q2 this fiscal year.