After a fall, winter and spring made memorable to snowmobilers and snowmobile dealers by supply-chain-fueled product shortages and long-delayed deliveries of ordered machines, sales of new snowmobiles declined a surprisingly low amount for the 2022 sales season.

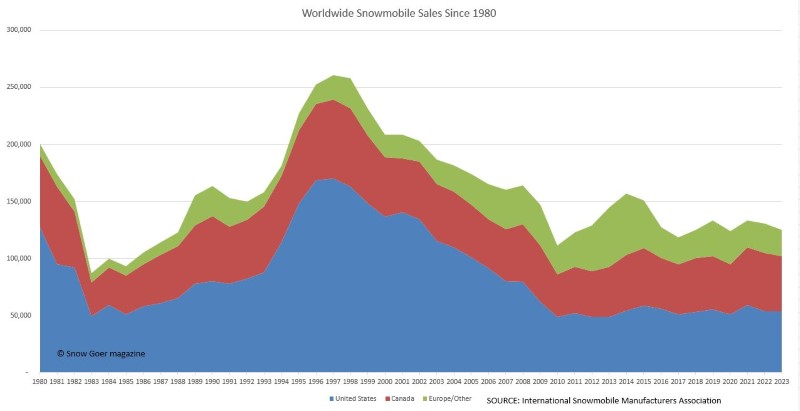

According to data announced recently by Ed Klim, president of the International Snowmobile Manufacturers Association (ISMA), worldwide sales of new snowmobiles were 130,644. That’s a 2.1 percent decline from the 133,444 recorded the previous season.

Most of the decline was in the U.S. sales numbers, as Canadian sales inched up slightly and sales on the other side of the Atlantic Ocean also crept up.

Annual sales in the snowmobile market are a reflection of “new” models sold and delivered to customers between May 1 the previous year through April 30 of the current year. They include new/current model machines (in this case, 2022 models) plus recent, non-current new models that were still in inventory at dealerships.

Orders of new 2022 snowmobiles were up dramatically during the February-April 2021 spring order period last year. Polaris officials, for example, publicly stated then that the company had its strongest Snow Check order period since the 1990s, and other brands reported similar results off-the-record.

Supply chain problems that disrupted whole-goods manufacturing by all five major brands (Polaris, Yamaha, BRP-owned Ski-Doo and Lynx plus Textron-owned Arctic Cat), though, put a kink is the pipeline. Consumer deliveries were massively delayed, plus Snow Goer and our sister trade publication, Powersports Business, heard from dozens of powersports dealers who had their orders for stocking units severely slashed.

Despite all of this, more than 130,000 units were purchased and delivered to consumers, and spring orders were strong again this year.

Behind The Numbers: U.S.

Sales of new snowmobiles in the U.S. were 50,943 for the 2022 sales season, a drop of 9.14 percent vs. the 59,234 sold in the 2021 sales season. Klim reported the numbers in a presentation to the approximately 325 grassroot leaders who had gathered June 9-11 at the International Snowmobile Congress in Dubuque, Iowa.

Geographically, the Upper Midwest accounted for 39 percent of those sales, while the West was 34 percent and the Northeast was 27 percent. That compares to 43 percent in the Midwest, 31 percent in the West and 26 percent in the Northeast a year earlier. This year’s numbers, though, may have been skewed by what the manufacturers could actually build and deliver during supply chain problems.

Digging in deeper, Klim said the No. 1 sales state was again Minnesota, with 6,630 units, while Wisconsin came in second with 5,847 and New York leapfrogged Michigan for third place – with 4,826 in the Empire State and 4,358 in the Wolverine State. Those were the only state for which data way released.

In his presentation, Klim blamed the transitions in the automotive market for Michigan’s big decline over the years. “Back years ago, we used to sell 33,000 new snowmobiles in Michigan, year-after-year. What happened? People decided to buy Hyundais and Kias and Toyota and other products, and [people] moved out of Michigan,” Klim said.

The same happened in other Upper Midwestern states like Indiana, Illinois and Wisconsin where automotive component manufacturing previous occurred on a broader scale, he said. “Those same folks that used to buy sleds up here are now buying ATVs in the southern part of the country,” Klim said.

Meanwhile, registrations of snowmobiles climbed in the 2022 season, jumping from 1,189,466 units a year ago to 1,264,097 this year.

“It shows us that the market is still strong, and a lot of people are out there snowmobiling.” Klim said. Wisconsin led the way with 233,422 registered snowmobiles, followed by Minnesota (201,400) and Michigan (approximately 173,000). No figures were release for other states.

A Slight Uptick In Canada

Sales of new snowmobiles in Canada climbed slightly in the 2022 sales season, going from 50,567 units a year earlier to 50,943 in the just-completed sales season. That represents a 0.74 percent increase.

Increasingly, the Canadian market is driven by Quebec, Klim said, where 19,582 units were retailed. “Quebec is a very, very large, strong market for the snowmobile business – they sell a lot more in Quebec than anywhere else.” Ontario was second with an also strong 12,648 units, he said, while sales of new sleds is western Canada has slipped over the years, he noted.

Overall, in the provinces and territories lumped together at Eastern Canada, 24,786 units were sold vs. 17,263 in Central Canada and 8,894 in the West. Klim stressed that, overall, Canada has hovered between 40,000 and 50,000 units rather consistently over the year 20 years while the U.S. has seen a rather large fall. “Snowmobiling is really part of the culture, I think, in Canada, and they are doing an excellent job. And I don’t think they have quite as many people moving south,” he noted.

Snowmobile registrations in Canada were 601,601 units vs. 596,101 the previous year.

Overseas Results

Sales of new snowmobiles outside of North America by the major brands increased by 9.46 percent, jumping from 23,643 to 25,880, according to ISMA data. In terms of raw numbers, most of the growth came in Russia, but Klim hinted that sales there could come to a screeching halt, given some of the corporate pull-outs from the country in the wake of its invasion of the Ukraine.

A total of 7,299 new snowmobiles were sold in Russia – a big jump over the 5,909 sold there last year and more in line with the 7,191 sold there in the 2020 sales season. Sales in Sweden also grew, with 8,671 recorded last season vs. 8,483 the season before. Sales also grew in Finland (3,736 vs. 3,437 the previous year).

Meanwhile, Norway continued to slide a couple of years after Klim predicted robust growth there. It recorded 3,527 in the 2022 sales season vs. 4,126 the previous year and 4,768 the year before that.

Sales in the rest of the world (lumped together by ISMA as “other”) grew to 2,647 vs. 2,288 the year before, but still well shy of the 3,912 recorded in 2020.

Editor’s Note: Every Snow Goer issue includes in-depth sled reports and comparisons, aftermarket gear and accessories reviews, riding destination articles, do-it-yourself repair information, snowmobile technology and more. Subscribe to Snow Goer now to receive print and/or digital issues.

My 2022 Ski-doo Was delivered at the end of January, but I am still waiting for parts. Still does not have the air shock or a working DESS post.

What are the sales numbers by each manufacturer, number of Skidoo’s, number of Polaris’s, Arctic Cat and Yamaha what seems to be the big secret.

The industry association (the International Snowmobile Manufacturing Association) does not publicly disclose that information. And, because they are off-road vehicles, there is no other means to capture that data with 100 percent accuracy. With on-road vehicles that require titling and licensing and such, state-by-state data is available, but it is not for off-road vehicles. So we can make estimates and educated guesses, but no factual data is publicly available. And we’re not expecting that to change anytime soon.